Securities and Mutual Funds

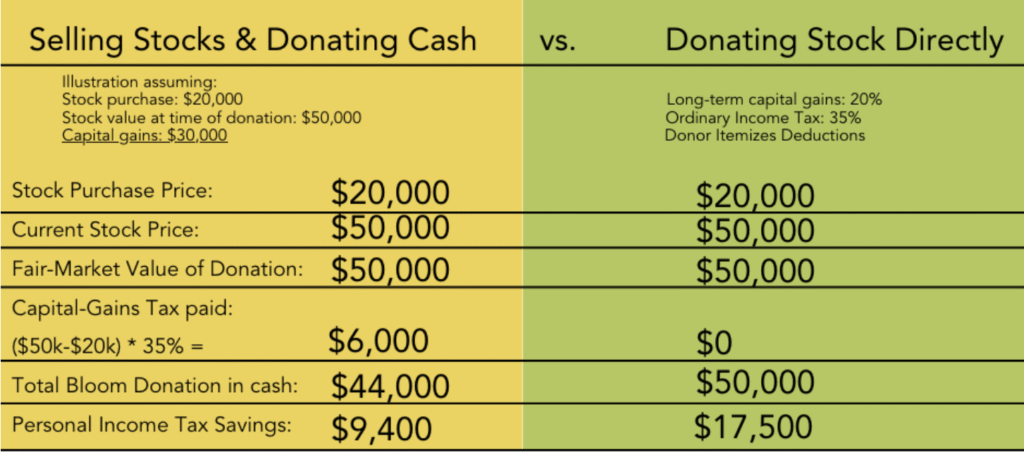

Giving appreciated assets such as stocks, securities, and mutual funds can help you avoid paying capital

gains taxes. And if you’ve had the assets for more than one year, you can also receive an income tax

deduction.

Give appreciated assets now and enjoy the benefits, or add us as a beneficiary of these assets and

eliminate estate and inheritance tax, making the most of your gift.

Benefits

- Gifts of assets can often save you far more on taxes than gifts of cash

- Avoid all capital gains taxes

- Receive an income tax deduction for the value of the assets (if you’ve had them for more than a year)

- Make an immediate impact in transforming the lives of children impacted by foster care.

How It Works

- Transfer appreciated securities directly to Bloom (and avoid all capital gains taxes).

- The securities are sold and the funds are immediately put to use for the greatest impact.

- Receive a tax receipt from Bloom for the value of the assets.

By donating stock directly, you can avoid paying capital gains tax and can deduct the full market value of the stock, resulting in higher tax total savings.

Please notify Nancy Connerat of your stock gift, including ticker symbol and amount of shares, as well

as your gift intent. In many cases, stock donations do not come with donor data. Providing the ticker

symbol of the stock donated, along with the number of shares, will help our team properly identify your

stock donation.

If you have any questions, do not hesitate to contact Katie Weaver, Director of Development.